The energy storage demand in emerging markets such as the Middle East, South America, Africa, and Southeast Asia is on the rise in 2024. New types of energy storage, with lithium-ion as a representative, are rapidly reducing costs. The penetration speed in segmented application scenarios and emerging markets is accelerating. Globally, lithium-ion battery-based energy storage remains dominant, with the market experiencing a growth of over 40 GWh in 2023, nearly three times that of 2022 and almost ten times that of 2021. Over 90% of installed projects use lithium-ion batteries.

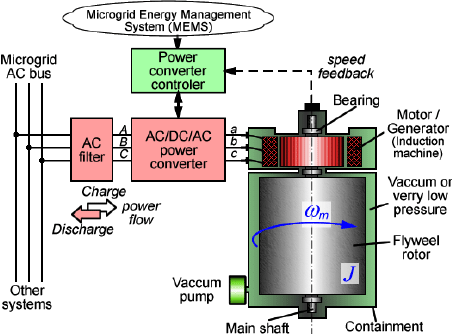

Flywheel energy storage is experiencing rapid development, especially since the introduction of mixed energy storage projects combining lithium-ion batteries and flywheels in 2020. The flywheel energy storage market has accelerated, with larger capacity demonstration projects continually entering the market. By 2023, the flywheel energy storage sector has produced unicorns, particularly in power storage, where flywheel energy storage possesses a monopolistic advantage. In the future, it is expected to play a greater role in system frequency regulation, voltage regulation, and critical support, especially with the ongoing push for carbon neutrality, which will lead to the rapid expansion of power storage markets.

The imbalance between supply and demand for lithium-ion batteries is expected to continue in 2024. The industrial and commercial energy storage market will steadily grow but is unlikely to exceed a 50% year-on-year growth rate. The high decentralization of the industrial and commercial energy storage market, combined with excessive attention in 2023, has negatively impacted project development. While it is a solid market, it lacks information asymmetry, and success will be determined by scale, cost, and project turnover efficiency in a market with no information asymmetry.

On the demand side, global front-of-the-meter (FOTM) energy storage remains robust. In 2023, countries in the Middle East, America, and Europe announced increased investments in renewable energy, with the United States and China remaining the primary markets for FOTM energy storage. The fragmented and aged facilities in the U.S. contribute to a high demand for energy storage, but challenges such as grid integration difficulties, labor shortages, and supply chain issues limit short-term installation growth. In China, technological innovation and continuous cost reduction efforts make lithium-ion energy storage costs competitive with pumped hydro storage, leading to continued market expansion.

Influence by dual carbon strategies and regional energy structure, front-of-the-meter energy storage demand is also growing in Southeast Asia, the Middle East, South Asia, Australia, South Africa, and South America. It is anticipated that global FOTM installations in 2024 will surpass shipment growth, with installed capacity exceeding 130 GWh. The global shipment of energy storage systems (front-of-the-meter and behind-the-meter) will exceed 160 GWh, and the global shipment of energy storage batteries will surpass 200 GWh.

The high expectations for the residential energy storage market in 2023 have led to continuous channel distributor inventory accumulation. Due to variations in global demand, installation speed, and product certification, different regions exhibit structural inventory distribution. Industry inventory is expected to be depleted earliest by January 2024 and latest by June, during which residential energy storage installation/shipment ratios will continue to adjust. Reflecting on the supply chain, companies will gradually return to rationality, and inventory ratios will fall to the range of 0.6-0.8.

In 2023, the U.S. residential energy storage market was affected by interest rate hikes and NEM3.0 policies, resulting in a decline in residential photovoltaic and energy storage installation intentions. With an expected end to interest rate hikes in 2024, the U.S. market still has significant growth potential. The global residential energy storage installation is projected to reach 22 GWh in 2024, with lithium-ion battery shipments for residential energy storage reaching 25 GWh.

Looking ahead, the global energy storage industry will thrive due to opportunities brought about by energy transition. China, the United States, and Europe are expected to be the three strongest markets in the next five years. China and the U.S. will focus on large-scale energy storage, while Europe, due to factors such as a more dispersed power system and the Russia-Ukraine conflict, will see an increasing proportion of residential energy storage.