In 2023, the newly installed capacity of photovoltaic (PV) systems experienced significant growth. However, the industry faced intensified competition due to factors such as capacity expansion, continuous decline in the prices of products across the supply chain, and rapid technological advancements.

Looking ahead to 2024, the annual growth of newly installed PV capacity is expected to maintain a relatively high pace but may slow down compared to 2023. The prices of PV products are likely to persist at lower levels, further intensifying competition within the industry. Technological innovation is set to accelerate, emphasizing that only new technologies and products can usher in a new era of prosperity.

The anticipated slowdown in the growth rate of PV installations in 2024 can be attributed to various factors, including grid integration challenges, land usage concerns, and policy influences. Distributed PV, in particular, faces constraints in widespread adoption due to issues related to grid connection, limiting its extensive deployment. On the other hand, centralized PV is impacted by factors such as land availability and environmental considerations.

In 2023, the European solar energy market experienced its third consecutive year of growth, with an increase of at least 40%. However, the forecast for 2024 indicates a slowdown in the EU photovoltaic installation rate to 11%. Consequently, the projected additional installed capacity in the EU for 2024 is estimated to reach 62 GW. In 2023, Germany reclaimed the top spot with 14.1 GW, followed by Spain (8.2 GW), Italy (4.8 GW), Poland (4.6 GW), and the Netherlands (4.1 GW). In Central and Eastern Europe, countries such as the Czech Republic, Bulgaria, and Romania all exceeded the 1 GW threshold in annual solar additions. Solar energy has been instrumental in assisting Europe in its energy crisis, but now the continent must reciprocate by supporting solar energy to achieve the targeted annual deployment of 70 GW by 2030.

Predictions suggest that the new PV installations in Europe will continue to grow by 19% in 2025, reaching 73.8 GW based on the 2024 foundation of 61.6 GW. Subsequently, the forecast for 2026 is a capacity of 84.2 GW, and by 2027, an anticipated achievement of 93.1 GW. In this scenario, Europe may potentially reach an annual installation of 100 GW by 2026. However, external factors such as trade disputes may impact the projections, leading to a lower growth scenario. In such a case, the annual new installations in Europe might only experience a marginal increase to 58.7 GW by 2027.

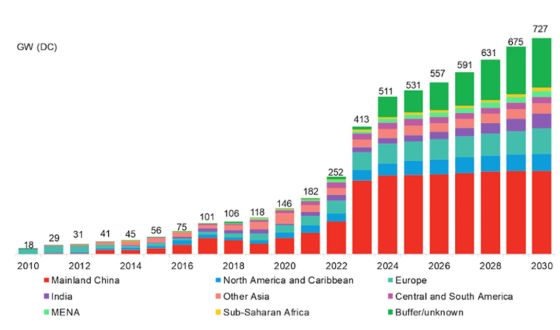

Globally, it is anticipated that the growth rate of new PV installations will moderate in 2024, returning to rational growth. Insufficient grid capacity and challenges in integrating wind and solar power have become key constraints for countries striving to maintain high growth in PV demand. The full potential of global PV installations is expected to be unleashed only after grid upgrades or a substantial increase in energy storage installations.

Profitability across the entire PV industry chain hit a low point in 2023. While a few leading companies with cost, technology, and market resource advantages still have some profit potential, second and third-tier companies with weaker financial positions face greater operational pressures.

Against this backdrop, the operating rates and inventory of companies are affected, and the elimination of outdated production lines is accelerating. The progress of some newly added capacity construction is slowing down. Apart from significant fluctuations in demand, rapid technological iterations in the PV industry mean that market increments will be met by new technological products. In 2024, the PV industry will continue its structural adjustment, with a more pronounced industry differentiation. New technologies and capacities are expected to replace outdated ones. Looking ahead, the PV industry is a long-term venture, and only through new technologies and products can it enter a new cycle of prosperity.